can you buy a house if you owe the irs

Home sales profits are considered capital gains taxed at federal rates of 0 15 or 20 in 2021 depending on. Can you buy a home if you owe the IRS money.

How To Give Your Home To Your Adult Child Tax Free Marketwatch

The IRS can place a lien or levy on a home that is currently.

. The good news is that the IRS has absolutely no authority over the lenders whose business it is to decide whether or not you are eligible to buy a home. There is a possibility you can become a homeowner even with tax liabilities. However if the tax debt transitions into a tax lien this may hinder your chances of.

If you cant pay your tax debt it doesnt mean the IRS will automatically file a tax lien so you wont be able to purchase a home. However if the tax debt transitions into a tax lien this may hinder your chances of. Is money from the sale of a house considered income.

Its still possible but youll be seen as a riskier borrower. You can avoid tax liens by communicating with. If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a mortgage.

Can you still buy a house. The short answer is yes. Howard a certified public accountant.

Can I buy a house if I havent filed taxes. It is possible to buy a house if you owe taxes says Ebony J. Having tax debt also called back taxes wont keep you from qualifying for a mortgage.

The good news is you can buy a house even if you owe tax debt. Buying a house while owing money to the IRS can seem like an insurmountable obstacle but tax debt cannot. But making the process as seamless as possible will require strategic planning on your behalf.

Yes you may be able to buy a single family house or condo in Los Angeles Calif. The short answer is yes and no. Can you get a conventional loan if you owe the IRS.

A n individual can purchase a home if money is owed to the Internal Revenue Service IRS. In reality if the IRS does not already know when you buy or sell a house it is just a matter of time before they find out. The long answer is that whether you will get the mortgage has.

You havent paid your taxes over the past few years and you do owe a significant amount of back taxes to the IRS. You do NOT need to pay off the entire tax debt that you owe in order to qualify for a mortgage. It is possible to buy a house if you owe taxes says Ebony J.

However if the tax debt transitions into a tax lien this may hinder your chances of. In short yes. The answer to whether you can qualify for a mortgage if youre on a tax repayment plan is yes as long as you meet the above conditions.

There is a penalty of 05 per month on the unpaid. The bad news is that the money you. Similarly can you purchase a house if you owe the IRS.

Howard a certified public accountant. Howard a certified public accountant. The IRS will provide up to 120 days to taxpayers to pay their full tax balance.

The answer to whether you can qualify for a mortgage if youre on a tax repayment plan is yes as long as you meet the above conditions. Many homebuyers wont purchase a home with a lien on it so sellers often agree to use the proceeds of the sale to pay off any unpaid debts and get rid of the lien. It is possible to buy a house if you owe taxes says Ebony J.

But you may have to actively work on the tax debt before a bank will approve a home. Depending on your situation you may be able to buy a house while you owe taxes. If the program youre enrolled in is an installment agreement your.

Depending on the type of. Its possible to buy a house if you owe the IRS but you must be enrolled in a Fresh start Program. Can you get a conventional loan if you owe the IRS.

Theres no fee to request the extension.

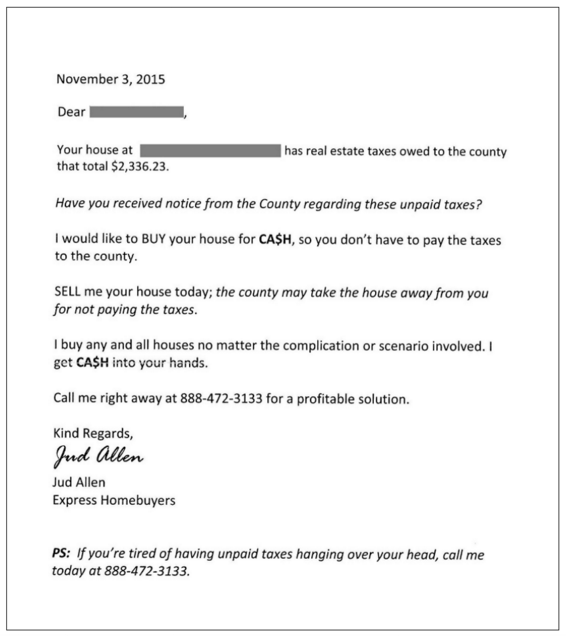

Can I Sell My House When I Owe Property Taxes Pavel Buys Houses

Can You Buy A House If You Owe Taxes Credit Com

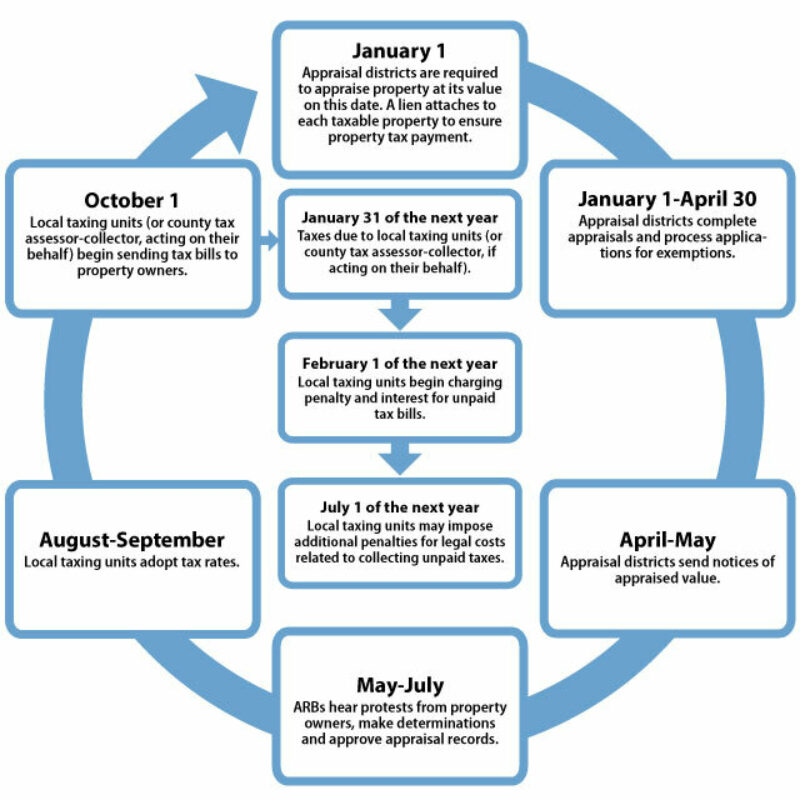

Florida Property Tax H R Block

Can You Sell A House If You Owe Taxes Yes But Let S Talk Liens Youtube

Irs Debt Relief Dallas Bankruptcy Lawyer Allmand Law Firm Pllc

Crypto Investors How To Find Out If You Owe Taxes On Your Cryptocurrency The Motley Fool

Can I Sell My House If I Still Owe Money Leave The Key Homebuyers

Can You Buy A House If You Owe Taxes Credit Com

Treasurer S Office Slams False Claims In Letter From Home Buying Firm Arlnow Com

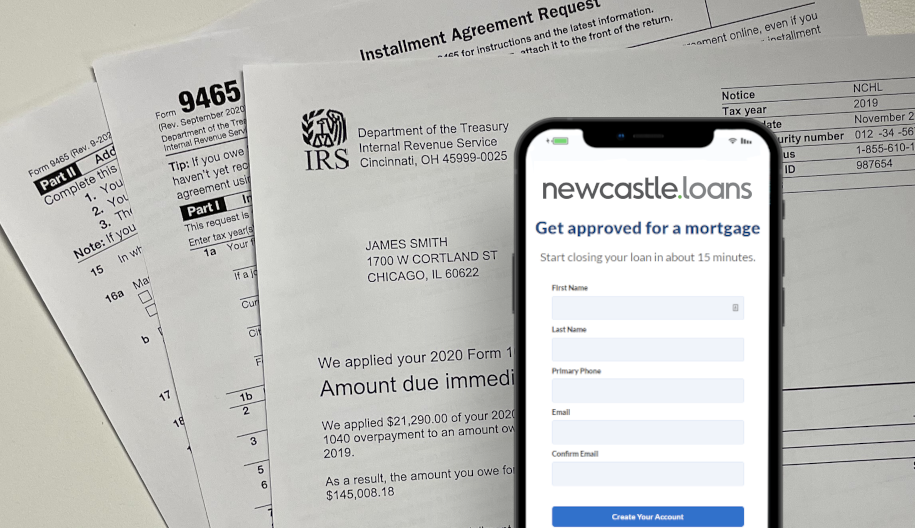

How Much Do You Owe The Irs Here S How To Check

Can I Buy A House If I Owe Back Taxes

All About Property Taxes When Why And How Texans Pay

What To Expect When Buying A House While Owing Taxes

Property Tax Calculator Estimator For Real Estate And Homes

Can You Purchase A House If You Owe Taxes

Can You Buy A House If You Owe Taxes The Turbotax Blog

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs